7 Questions to Ask Yourself to Help Spot Fraud

Communication has never been easier than it is today. That comes with both its ups and downs, one of the downs being an increase in scams and fraudulent communications. Here are some quick questions to ask yourself if you feel suspicious of an interaction you are having. Although some bad actors may get through some of these precautions, the best thing you can arm yourself to fight fraud is information.

- Is it urgent? If I slow down the process, does the person get upset?

Often, scammers are counting on you to feel panicked and rush through an interaction. The faster they can get you through something, the less likely you are to question something, and you are more likely to give up personal information.

- Has this company contacted me this way before?

Companies have pretty standard communication for a reason. This allows you to see something and associate it with trust. If your electric company has never called you to give you a promotional rate, it is a good idea to hang up and call them back with the number you find on their website. The same goes for texts, emails, and sometimes even physical mailers. If you are ever unsure of a communication, go directly to their website and contact them from the information listed there.

- Are there spelling mistakes?

In many cases, scams originate from outside the country and those who are committing the fraud do not speak English as their first language which can be evident in their communications. There are, of course, two things to note with this. First, many companies employ workers who also do not speak English as their first language. Additionally, with the invention of AI and advancements in technology, fraudsters are able to type what they want into a search engine and make it sound more legitimate.

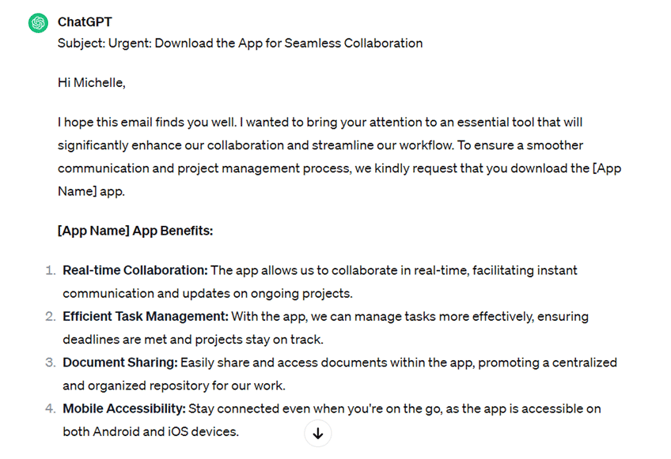

See an example of that here -

The prompt:

The response (that keeps going!):

- Am I expecting this communication and does it make sense?

Although companies contact customers all the time with things they may not expect, it is important to make sure that the communication makes sense. If your aunt, who only ever emails you around the holidays, is emailing you in July asking you to send money, it is probably a good idea to call your aunt personally and talk with her about it personally.

- Are they telling me to go to a link or download anything?

Nowadays, companies are constantly sending you links when they have deals and there are many good reasons why someone would send you a link or ask you to download something. This is just something to be cautious of in combination of all the other tips. Ask yourself again, does this make sense?

- Are they asking personal information?

Beyond confirming certain details, companies will not call you and ask you for your personal information. Fraudsters do this so they can collect your information and use it to get through your security settings in an effort to access your bank accounts and beyond. If you are speaking with someone and they are attempting to get personal information from you, this is a good time to hang up and call the company back directly from the number listed on their website to ensure that you are actually speaking with a representative of the company.

- Is it too good to be true?

Be cautious! We all love a good deal or opportunity, but be very aware that scammers will prey on this. They often know the psychology of what consumers want. This could look like a free gift card or even a job opportunity. Scammers will take advantage of those in need by offering something that feels too good to pass up.

These seven questions will not protect you from all fraud, but it is important to stay educated and vigilant to help protect your security. Next time you are unsure of an interaction you are having, run through these questions and, as always, don’t be afraid to tell them that you will call them back.

If you fall victim to a scam, swift action is essential to minimize the damage. Here are steps to take:

- Alert your banks and credit institutions: Inform them of the situation to protect your accounts. If you are an On Tap member, call in and speak with someone at 303.279.6414.

- Report the crime to local law enforcement: Provide them with as much information as possible.

- File a complaint with the FBI: The FBI investigates and combats cybercrime, including online fraud. File a complaint here: https://www.ic3.gov/

- Report the scam to the FTC: The Federal Trade Commission (FTC) collects information about scams to help prevent others from becoming victims. Report the scam here: ReportFraud.ftc.gov.

.png)