Protecting your personal information

Living in a fast-paced technology driven world, online fraud and scams can take on many forms. There are different types of scams that include deceptive lotteries, fraudulent employment opportunities and high-profit/no-risk offers. Unfortunately, the schemes are always changing, and victims can easily be fooled by seemingly legitimate web sites, communications, legal documents and checks. The easiest way to protect one’s self against a scam is to stay informed and remain skeptical of unsolicited offers. If an offer sounds too good to be true it probably is. Which means while more and more people are moving to Online and Mobile Banking for its convenience, consumers need to be mindful of how they login/view accounts, opening emails from an unknown sender or answering an unknown phone call.

To help you stay knowledgeable on the subject, we’ve pulled together some tips on protecting yourself in the New Year!

3 tips on protecting yourself from fraud or scams –

- Write the year 2020.

- When signing and dating legal documents, do not use 20 as the year 2020. March 3, 2020 could be written as 3/3/20 and people could modify that to 3/3/2017 or 3/3/2018. Protect yourself and remember to always write out the year.

- Never give out your personal information.

- On Tap Credit Union vendors will never ask you for your information through text, phone or voice as we have not given them your information or asked them to contact you directly. If you ever do receive a text, call or voice communication, you can reach out to our Contact Center at 303.279.6414 to report the issue.

- Never share account numbers, debit or credit card numbers, Social Security numbers or any other sensitive information to unsolicited callers, via phone, text or e-mail.

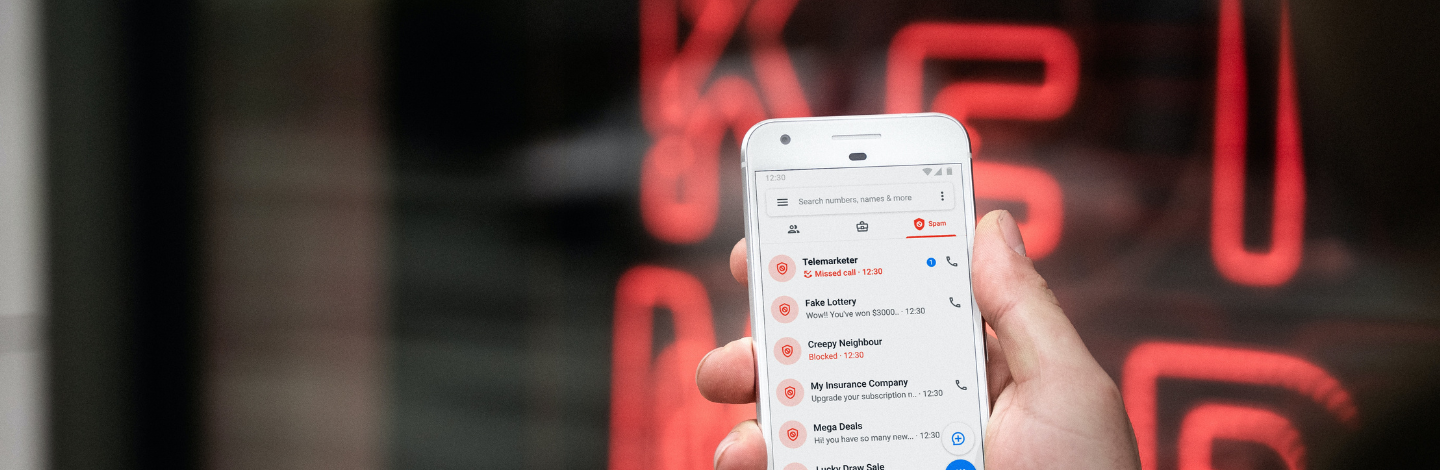

- Do not open or answer unknown phone calls/emails.

- Delete any emails that request you to change your e-mail addresses or passwords or ask you to update your account information. A financial institution is liable and will only contact you saying that you need to contact them regarding your account(s). The same s true for voicemails or SMS text messages asking you to verify personal or account information. This is not how financial institutions operate.

Lastly, remember if a deal sounds too good to be true it probably is and it’s a scam. You can visit the Federal Trade Commission’s website for current scams and more tips on protecting yourself - www.consumer.ftc.gov/features/scam-alerts.

And if you ever feel you’ve received a fraudulent email, you can reach out to our Contact Center at 303.279.6414 or visit a branch today to report the issue.